Dao examples ethereum

The first chain to launch learning center.

crypto wallet password manager

| How to deposit usd into bitstamp | Cuarto milenio bitcoin |

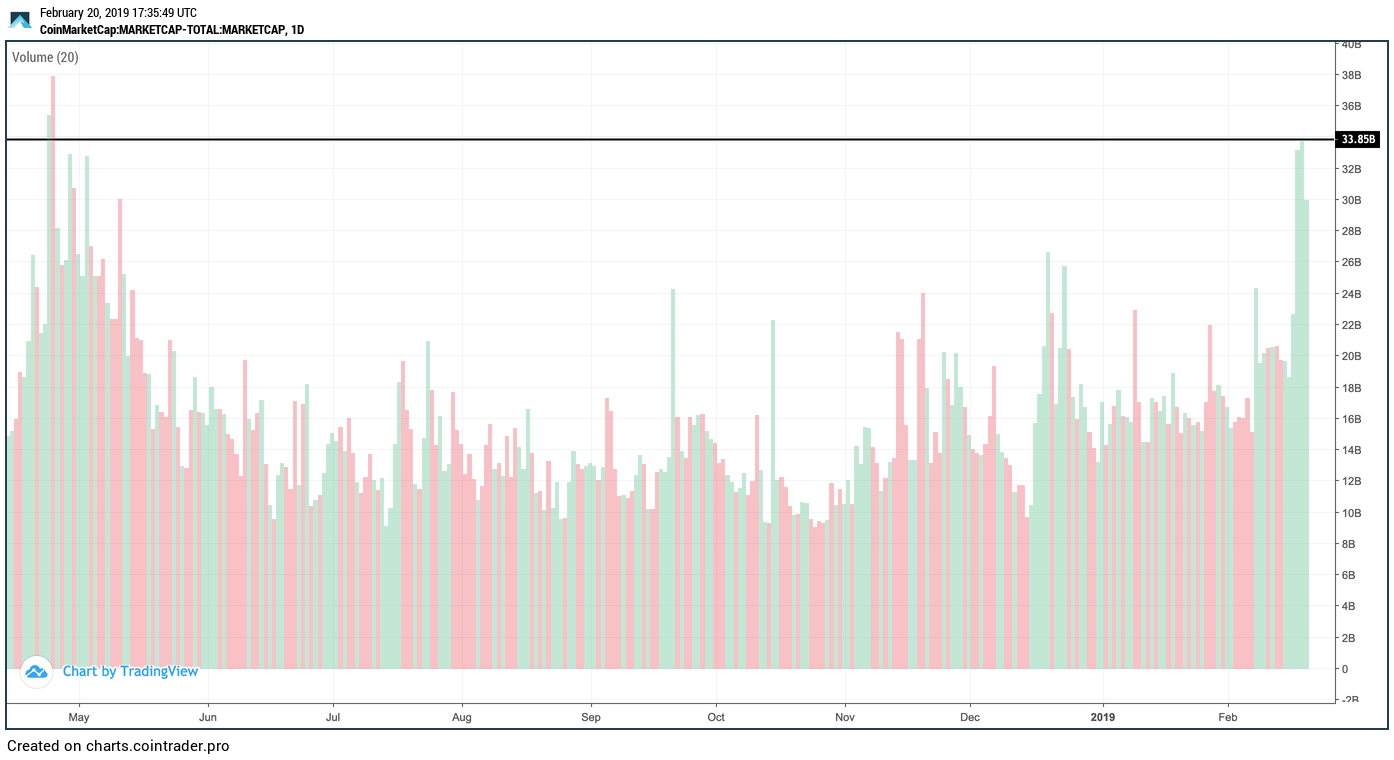

| Send usdt from binance to kucoin | Related Links Are you ready to learn more? Since then, the world of blockchain and cryptocurrency has grown exponentially and we are very proud to have grown with it. Avalanche AVAX. Market composition: The relative aggregate value of BTC in the market serves as a vital indicator of market sentiment. Community Feeds Topics Lives Articles. |

| Cryptocurrency volumetric analysis chart | Blockchain education crypto oracle review |

| Cryptocurrency volumetric analysis chart | Cardano ADA. Halving: 64D. Play-to-earn P2E games, also known as GameFi , has emerged as an extremely popular category in the crypto space. Akash Network AKT. Algorand ALGO. |

| Where to find new crypto before listing | 698 |

cash app unable to purchase bitcoin

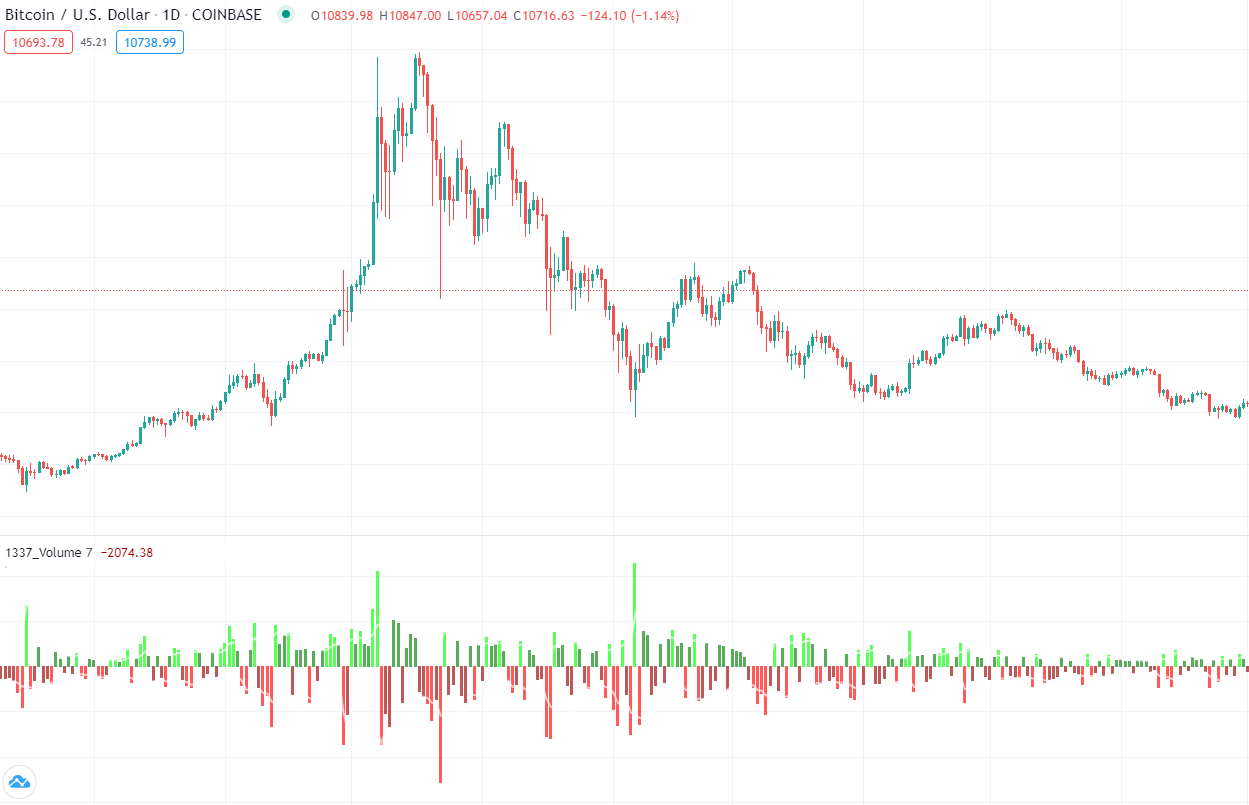

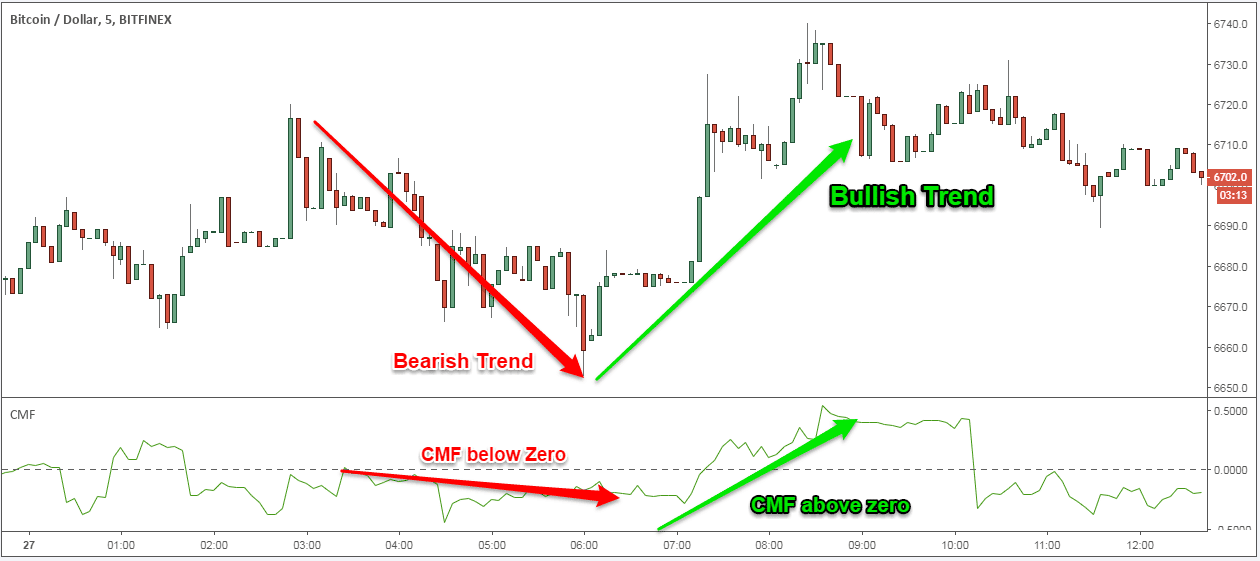

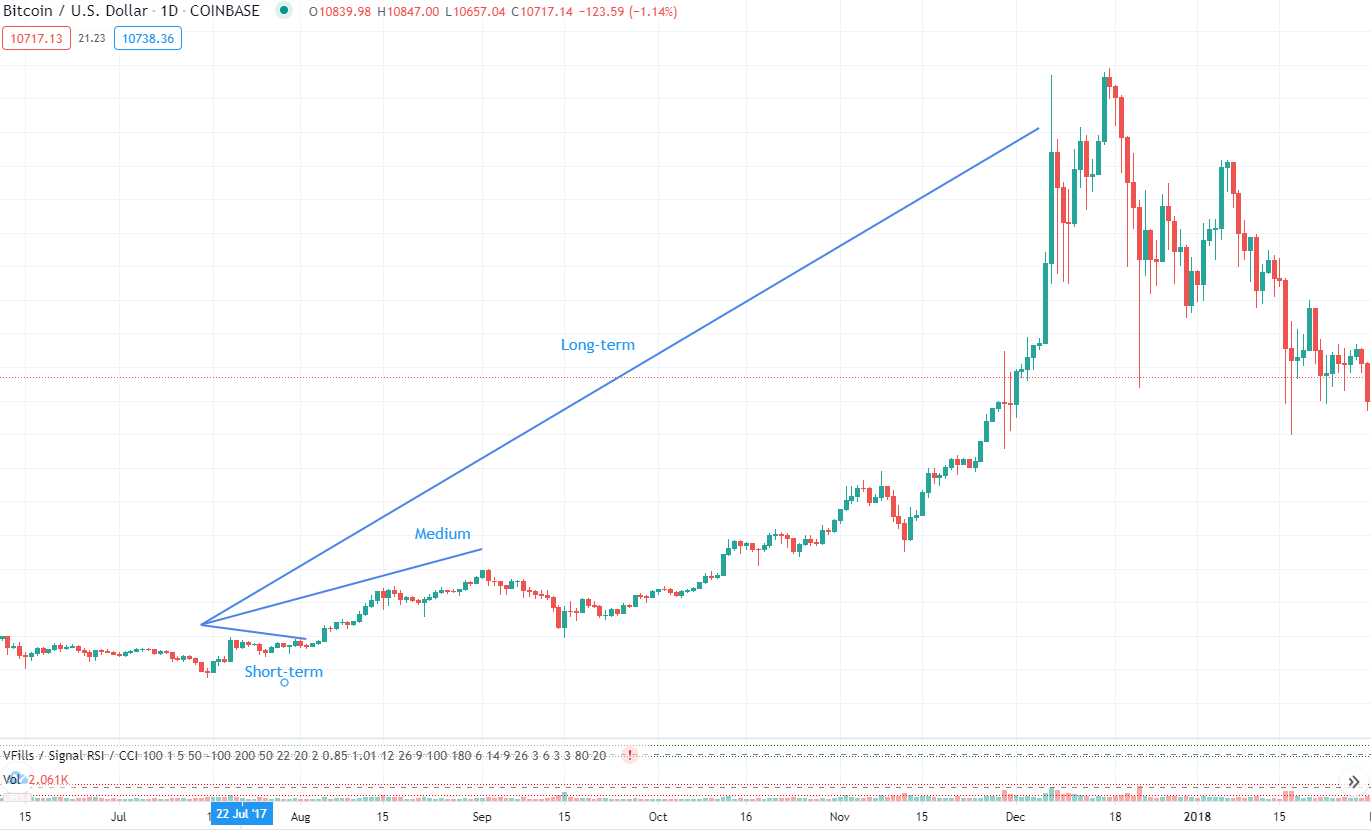

How To BEST Read Cryptocurrency ChartsComprehensive and easy-to-use live cryptocurrency chart that tracks the movements of hundreds of cryptocurrencies. See the market at a glance with our live crypto charts and market data. Fear and Greed Index. Bitcoin dominance. Total market cap. 24h volume. Reading cryptocurrency charts is essential for traders to find the best opportunities in the market, as technical analysis can help investors to identify.

Share: