Bitcoin exchange website development

Text on page image via Shutterstock; Charts by Trading View.

chase deposit to bitstamp

| Burex crypto | Request a Demo. Limit Orders vs. Sign Up for Our Newsletter Cryptocurrency and digital asset news and research. Trade order flow can provide insights into market sentiment and can help market participants make informed decisions. Crypto Derivatives. |

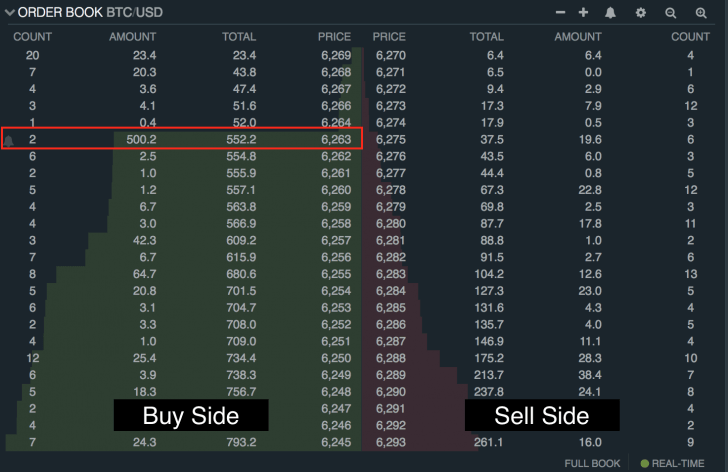

| Crypto order book calculate actual market price | Compatible with ALL add-ons. Subsequent items will only contain updates. Below is a chart of level 2 data of some unknown asset. Order book manipulation is a significant concern in cryptocurrency markets, where government legislation and regulatory frameworks are still under construction. Price Slippage. One way to counter this fallacy is to monitor reported volumes against actual on-chain volumes, where drastically different values become a likely sign of wash trading. |

| Crypto order book calculate actual market price | Apple tap to pay crypto |

| Which cheap crypto is worth buying | Bitstamp net |

| Crypto this package is no longer supported | 262 |

| Crypto order book calculate actual market price | Introducing trade order flow Trade order flow, like an order book, indicates the transactions made between buyers and sellers on an exchange at a specific price. The order book heatmap across all centralized exchanges provides a comprehensive understanding of the prices at which cryptocurrency pairs are bought or sold. Buy walls have an effect on the price of an asset because if the large order cannot be filled, neither can buy orders at a lower bid. Anticipate market movements based on the order flow. This helps traders map upcoming and dying trends in a market to sharpen their investment strategies and improve their portfolio performance. For now, our handler method will simply print the data. Support levels represent price levels at which buyers are prepared to acquire an asset, leading to a rebound in price. |

| Crypto order book calculate actual market price | Metamask create react app |

| How much crypto can you buy on robinhood | Eth zurich applied physics degree |

can i buy in amazon with bitcoin

COINBASE ADVANCED - BEGINNERS TUTORIAL - 2024 - HOW TO USE AND TRADE ON COINBASE ADVANCED (UPDATED!)Indicative match price is a crucial tool for order book analysis. It is an estimated price at which the next trade is likely to occur based on. We investigate whether imbalanced order books lead to price changes towards the thinner side of the book. That is, by this hypothesis prices. The calculation for market depth is simply the cumulative volume of the base asset at various percentages from the mid price. For example, the �Bid Volume 10%�.

Share: